Hey there! Today, I want to talk about a very important form called the IRS Form I-9. This form plays a crucial role when it comes to verifying the eligibility of employees to work in the United States. As an employer, it is your responsibility to ensure that all your newly hired employees complete and submit this form.

What is the IRS Form I-9?

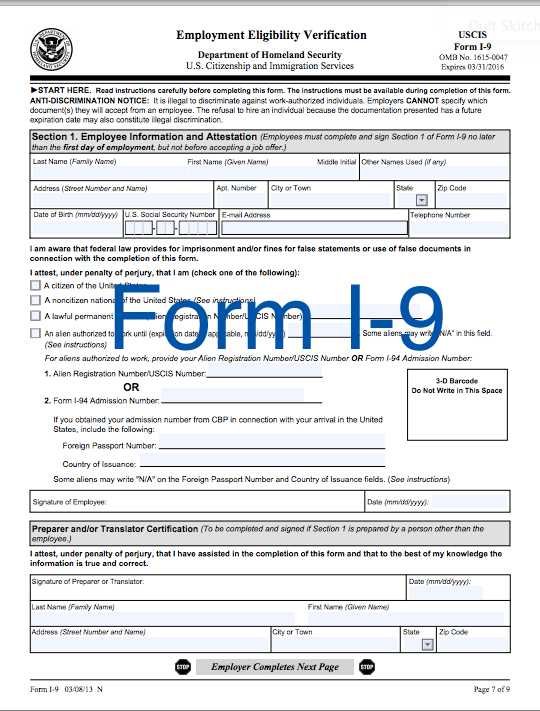

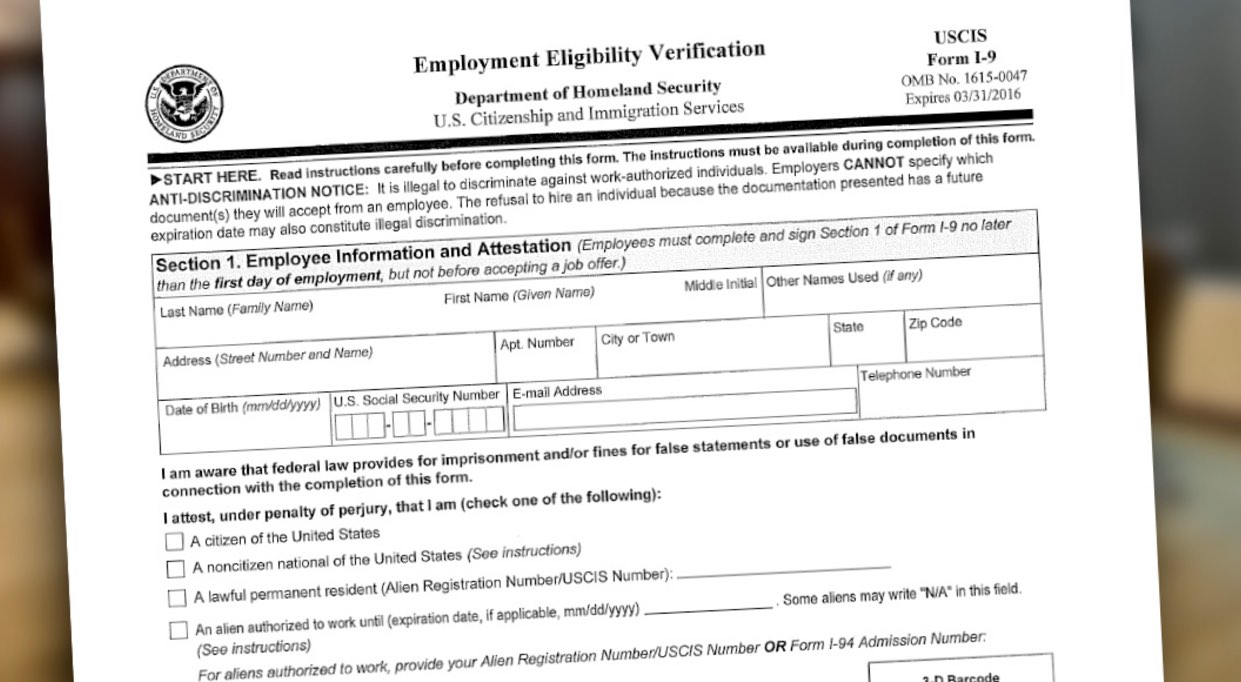

The IRS Form I-9, also known as the Employment Eligibility Verification Form, is used to verify the identity and employment authorization of individuals hired for employment in the United States.

The IRS Form I-9, also known as the Employment Eligibility Verification Form, is used to verify the identity and employment authorization of individuals hired for employment in the United States.

When you hire a new employee, you must ensure they complete Section 1 of the IRS Form I-9 on or before their first day of employment. This section requires them to provide personal information such as their full name, date of birth, address, and social security number (SSN). They must also attest to their employment eligibility status and sign and date the form.

Once the employee has completed Section 1, you, as the employer, are responsible for completing Section 2 of the form. This section requires you to physically examine the employee’s documentation to verify their identity and work authorization. The IRS Form I-9 provides a list of acceptable documents, such as a U.S. passport, driver’s license, or social security card, which employees can use to establish their identity and work eligibility.

Why is the IRS Form I-9 important?

The IRS Form I-9 is vital because it helps ensure that your employees are legally authorized to work in the United States. By completing this form, you are fulfilling your legal obligation as an employer and helping to maintain the integrity of the U.S. workforce.

The IRS Form I-9 is vital because it helps ensure that your employees are legally authorized to work in the United States. By completing this form, you are fulfilling your legal obligation as an employer and helping to maintain the integrity of the U.S. workforce.

Employing individuals who are not authorized to work in the U.S. can have serious consequences for both the employer and the employee. As an employer, you may face penalties, fines, and even criminal charges for knowingly hiring unauthorized individuals. On the other hand, employees who are not authorized to work may experience difficulties in obtaining employment, as well as potential legal consequences.

Furthermore, by properly completing the IRS Form I-9, you are protecting yourself against potential audits by government agencies such as the U.S. Immigration and Customs Enforcement (ICE) and the Department of Homeland Security (DHS). These agencies have the authority to conduct inspections and verify the employment eligibility documentation of both employees and employers.

Tips for completing the IRS Form I-9

Completing the IRS Form I-9 may seem overwhelming, but with a few tips, you can ensure accuracy and compliance:

Completing the IRS Form I-9 may seem overwhelming, but with a few tips, you can ensure accuracy and compliance:

- Read the instructions carefully: The IRS provides detailed instructions on how to complete each section of the form. Make sure you understand the requirements before starting.

- Use the most current version of the form: The U.S. Citizenship and Immigration Services (USCIS) regularly updates the IRS Form I-9. Always use the most recent version to avoid any issues.

- Double-check the employee’s documentation: When reviewing the employee’s documents, make sure they are valid and unexpired. Also, ensure that the documents presented match the information provided in Section 1 of the form.

By following these tips, you can streamline the process and mitigate any potential errors or discrepancies.

Final thoughts

As an employer, it is crucial to understand the importance of the IRS Form I-9 and ensure its proper completion. By doing so, you are not only complying with federal regulations but also contributing to a well-functioning and legal workforce.

Remember, the IRS Form I-9 serves as a powerful tool in maintaining the integrity of our nation’s labor force and protecting the rights of both employers and employees. So, make sure you stay updated with the latest version, invest time in understanding the instructions, and complete the form accurately for every newly hired employee.

Thank you for reading this informative post about the IRS Form I-9. If you have any questions or need further assistance, feel free to reach out. Happy form filling!