Hey everyone! Are you ready to take on tax season? We know it can be a daunting task, but don’t worry, we’ve got you covered. In this post, we’ll be discussing some important tax forms and resources that you need to know about, specifically for Pennsylvania residents. So, without further ado, let’s dive right in!

Form PA-40 Pennsylvania Income Tax Return

First up on our list is Form PA-40 Pennsylvania Income Tax Return. This form is essential for all Pennsylvania residents filing their income tax return. You can easily find this form and download it from this link. It’s important to carefully fill out this form with accurate information to ensure that your taxes are filed correctly.

First up on our list is Form PA-40 Pennsylvania Income Tax Return. This form is essential for all Pennsylvania residents filing their income tax return. You can easily find this form and download it from this link. It’s important to carefully fill out this form with accurate information to ensure that your taxes are filed correctly.

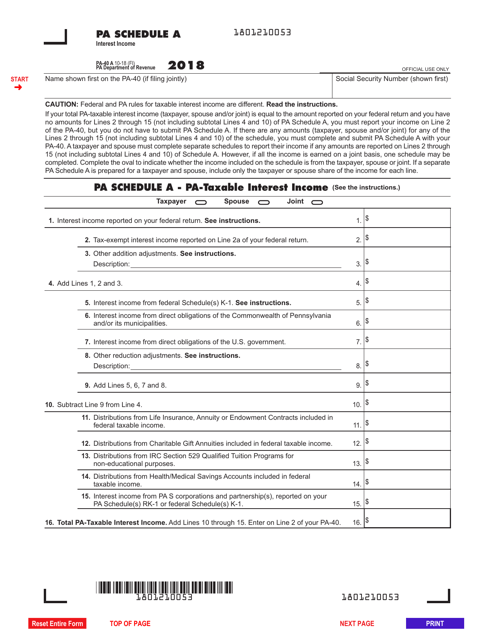

Form PA-40 Schedule A - 2018

Another important tax form to be aware of is Form PA-40 Schedule A - 2018. This form is used to report interest income for the tax year 2018. If you earned any interest income during that period, it’s crucial to include it in your tax return. You can access this form here and fill it out accordingly.

Another important tax form to be aware of is Form PA-40 Schedule A - 2018. This form is used to report interest income for the tax year 2018. If you earned any interest income during that period, it’s crucial to include it in your tax return. You can access this form here and fill it out accordingly.

Pennsylvania Income Tax Return PA 40 Revenue Pa Gov

For a seamless filing process, you can rely on Pennsylvania Income Tax Return PA 40 Revenue Pa Gov. This online resource provides a convenient platform for filling out and signing your tax return. You can find this resource and learn more about it by clicking here. Say goodbye to the hassle of paper forms and embrace the digital era!

For a seamless filing process, you can rely on Pennsylvania Income Tax Return PA 40 Revenue Pa Gov. This online resource provides a convenient platform for filling out and signing your tax return. You can find this resource and learn more about it by clicking here. Say goodbye to the hassle of paper forms and embrace the digital era!

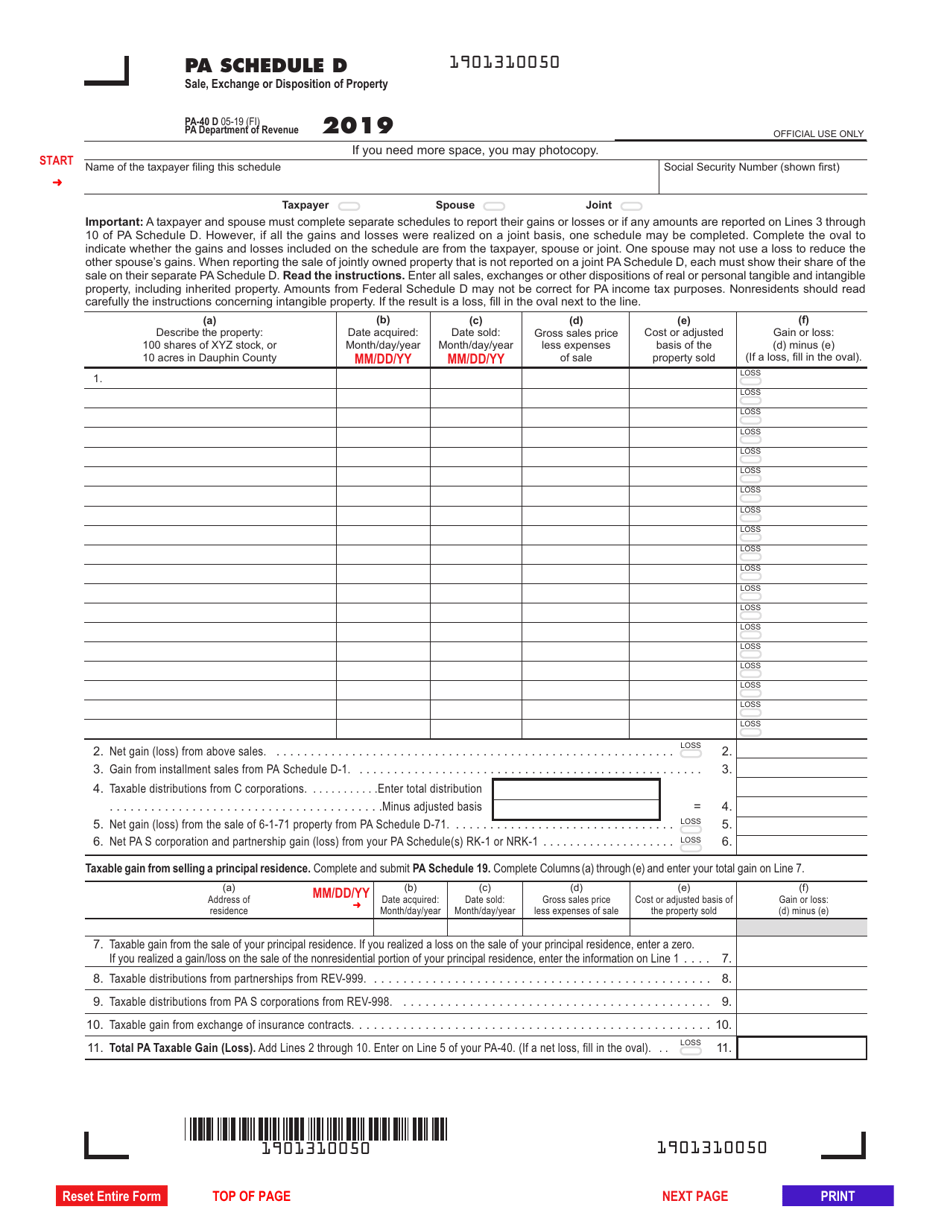

Form PA-40 Schedule D - 2019

Moving on, let’s talk about Form PA-40 Schedule D - 2019. This form is used to report any sale, exchange, or disposition of property during the tax year 2019. It’s essential to accurately document any such transactions to ensure compliance with tax regulations. You can find this form and fill it out online by visiting this link.

Moving on, let’s talk about Form PA-40 Schedule D - 2019. This form is used to report any sale, exchange, or disposition of property during the tax year 2019. It’s essential to accurately document any such transactions to ensure compliance with tax regulations. You can find this form and fill it out online by visiting this link.

2021 PA Form PA-40 ES (I)

Are you self-employed or have income that’s not subject to withholding tax? If so, you may need to file estimated tax payments. That’s where 2021 PA Form PA-40 ES (I) comes in handy. This form allows you to calculate and pay your estimated taxes for the year 2021. You can easily fill out and submit this form online. Check it out by clicking here.

Are you self-employed or have income that’s not subject to withholding tax? If so, you may need to file estimated tax payments. That’s where 2021 PA Form PA-40 ES (I) comes in handy. This form allows you to calculate and pay your estimated taxes for the year 2021. You can easily fill out and submit this form online. Check it out by clicking here.

Pa 40 Tax Form Printable

If you prefer printable tax forms, we’ve got you covered too! You can find a printable version of Pa 40 Tax Form by visiting this link. Simply download, print, and fill out the form at your convenience. Remember to submit it before the deadline to avoid any penalties or late fees.

If you prefer printable tax forms, we’ve got you covered too! You can find a printable version of Pa 40 Tax Form by visiting this link. Simply download, print, and fill out the form at your convenience. Remember to submit it before the deadline to avoid any penalties or late fees.

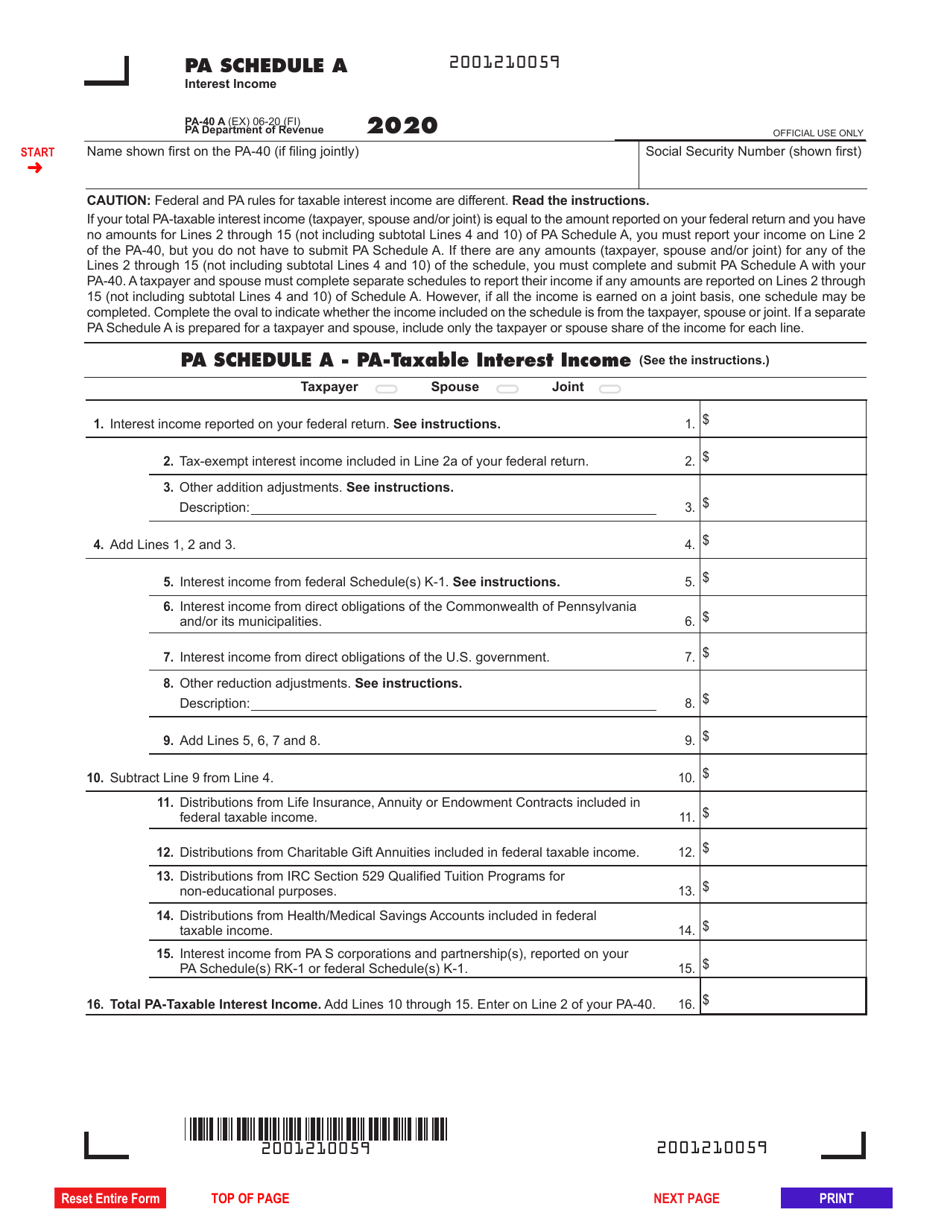

Form PA-40 Schedule A

For those interested in downloading a fillable PDF version of Form PA-40 Schedule A, we have you covered. This form is used to report interest income for Pennsylvania residents. Access it by clicking here and easily fill it out online or print it for offline completion.

For those interested in downloading a fillable PDF version of Form PA-40 Schedule A, we have you covered. This form is used to report interest income for Pennsylvania residents. Access it by clicking here and easily fill it out online or print it for offline completion.

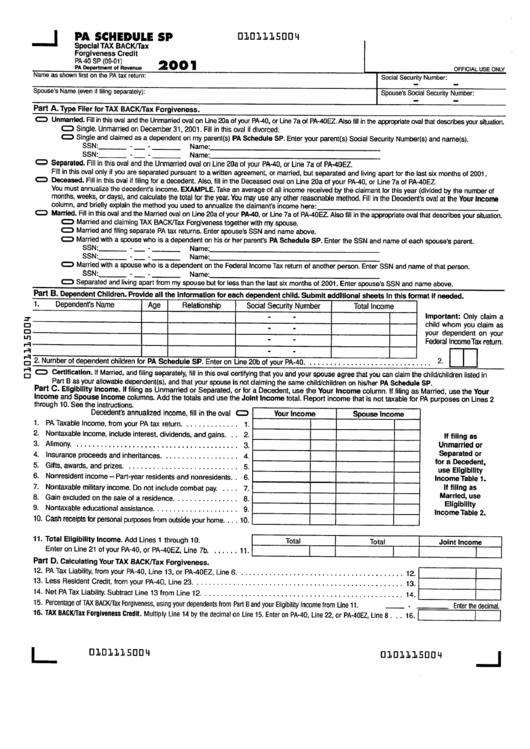

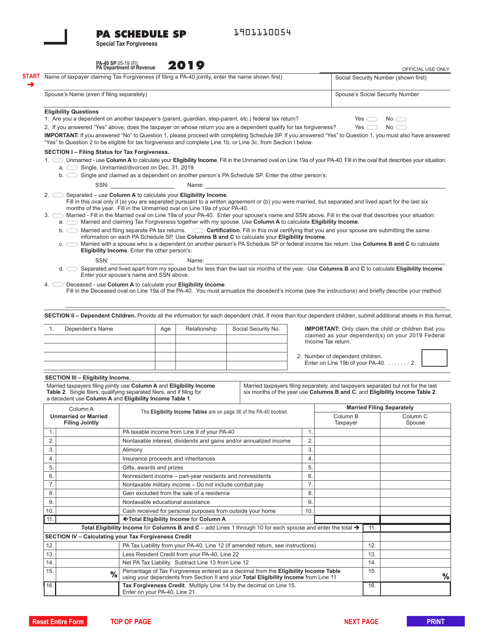

Form PA-40 Schedule SP - 2019

If you’re looking for special tax forgiveness options in Pennsylvania, you need Form PA-40 Schedule SP - 2019. This form allows eligible taxpayers to claim certain credits and deductions. It’s important to take advantage of every opportunity to reduce your tax burden. Access this form and learn more about it by visiting this link.

If you’re looking for special tax forgiveness options in Pennsylvania, you need Form PA-40 Schedule SP - 2019. This form allows eligible taxpayers to claim certain credits and deductions. It’s important to take advantage of every opportunity to reduce your tax burden. Access this form and learn more about it by visiting this link.

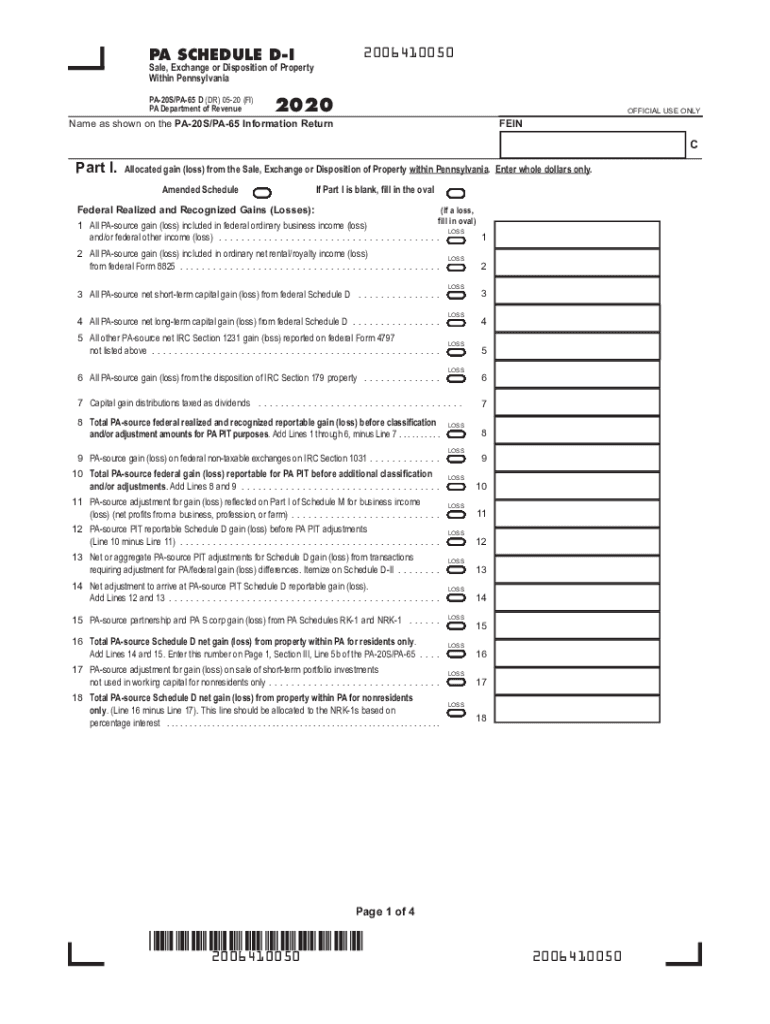

PA PA-20S/PA-65 D - Schedule D-I 2020-2022

Lastly, for all you business owners out there, make sure to check out PA PA-20S/PA-65 D - Schedule D-I 2020-2022. This form is specifically designed for partnerships, S corporations, and limited liability companies. It’s crucial to accurately report your business income and deductions, so don’t forget to include this form in your tax filing. You can easily access and fill it out by visiting this link.

Lastly, for all you business owners out there, make sure to check out PA PA-20S/PA-65 D - Schedule D-I 2020-2022. This form is specifically designed for partnerships, S corporations, and limited liability companies. It’s crucial to accurately report your business income and deductions, so don’t forget to include this form in your tax filing. You can easily access and fill it out by visiting this link.

And that’s a wrap! We hope this post provided you with valuable information and resources for your Pennsylvania income tax filing. Remember to consult with a tax professional or refer to the official Pennsylvania Department of Revenue website for any specific questions or clarifications. Happy filing, everyone!