When it comes to managing our taxes, it’s important to stay organized and up-to-date with the latest forms and regulations. One key document that plays a significant role in our tax filing process is the W-4 form. Understanding how to fill out this form correctly ensures that the right amount of taxes is being withheld from our paychecks throughout the year. In this post, we will discuss the importance of the W-4 form and provide you with valuable information on how to complete it.

W-4 Form - A Vital Tax Document

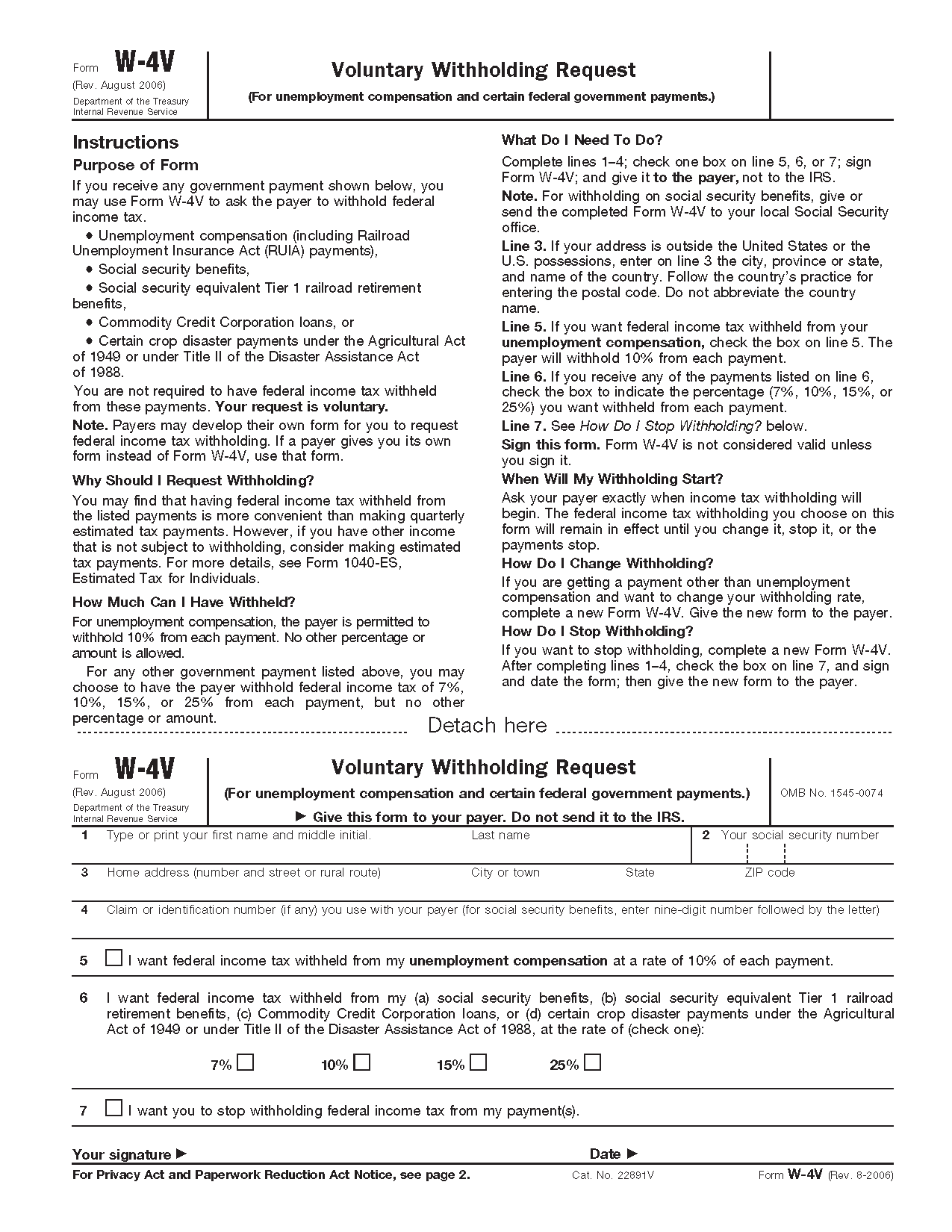

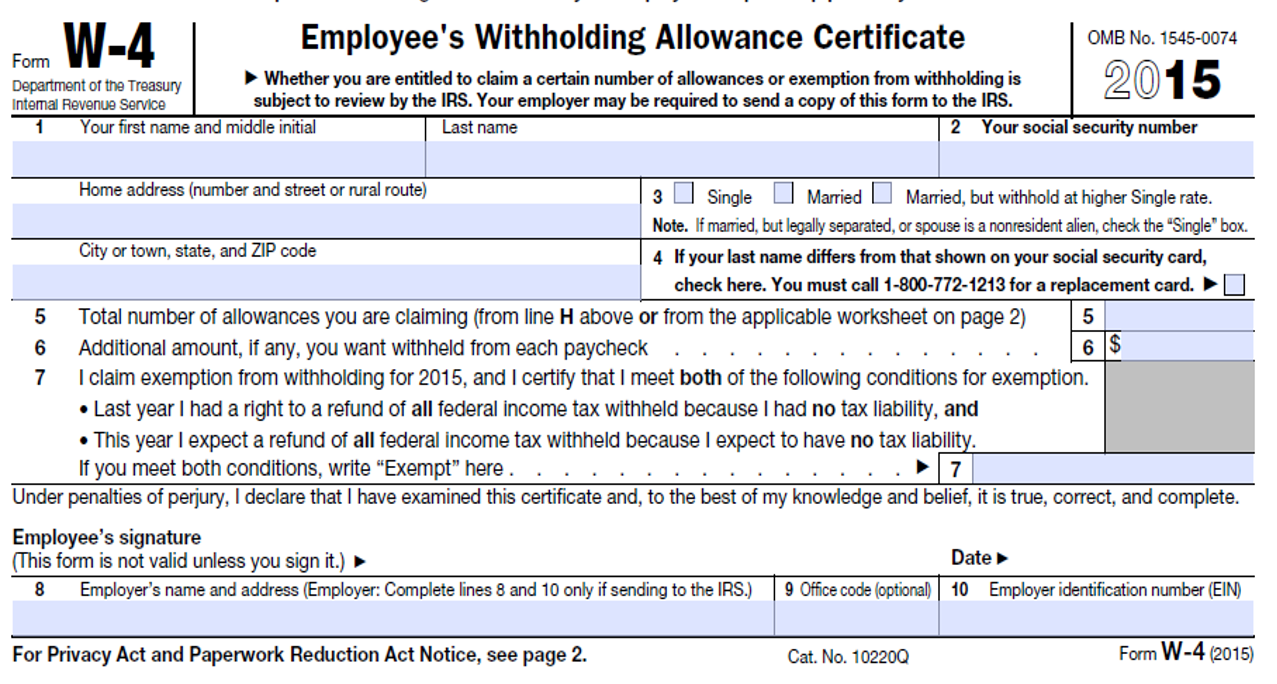

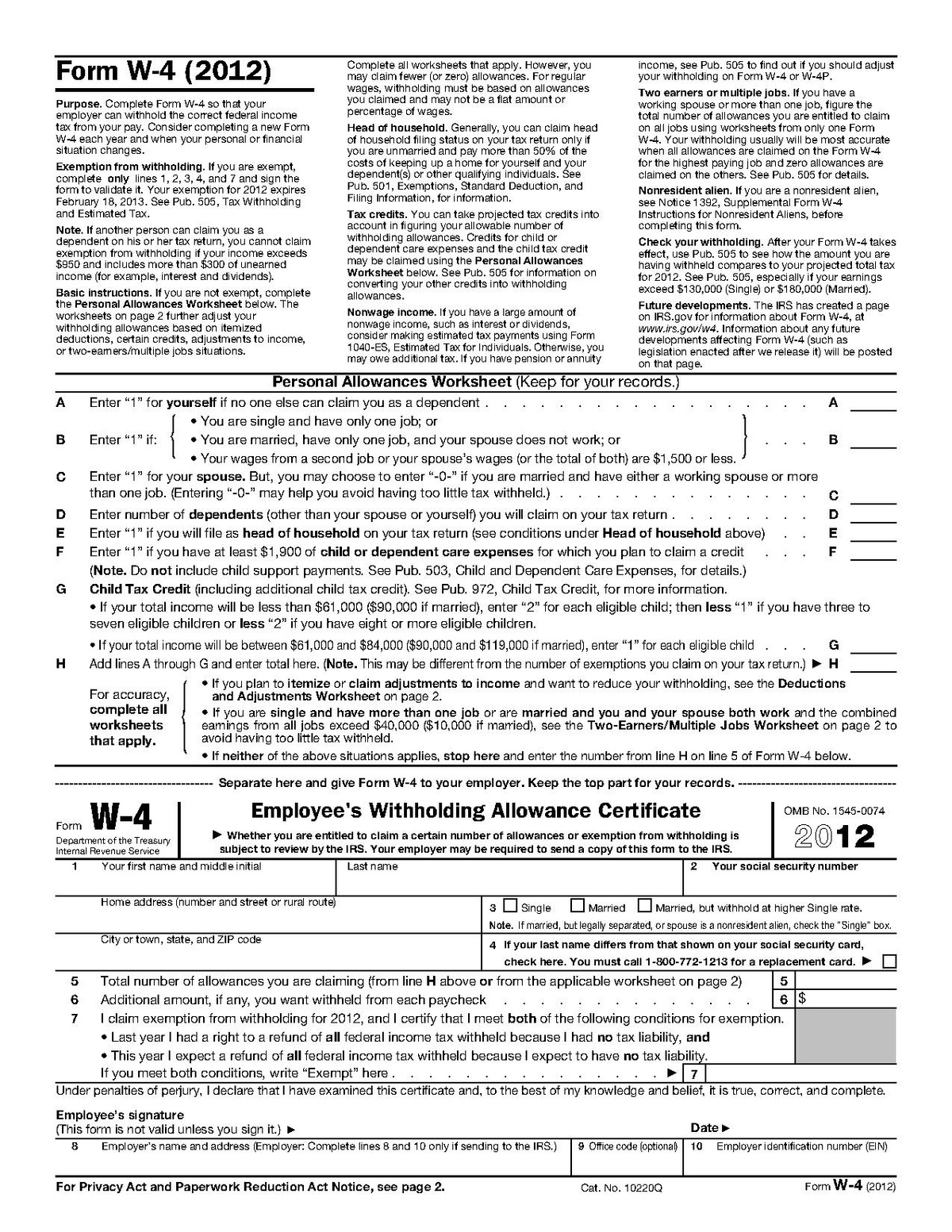

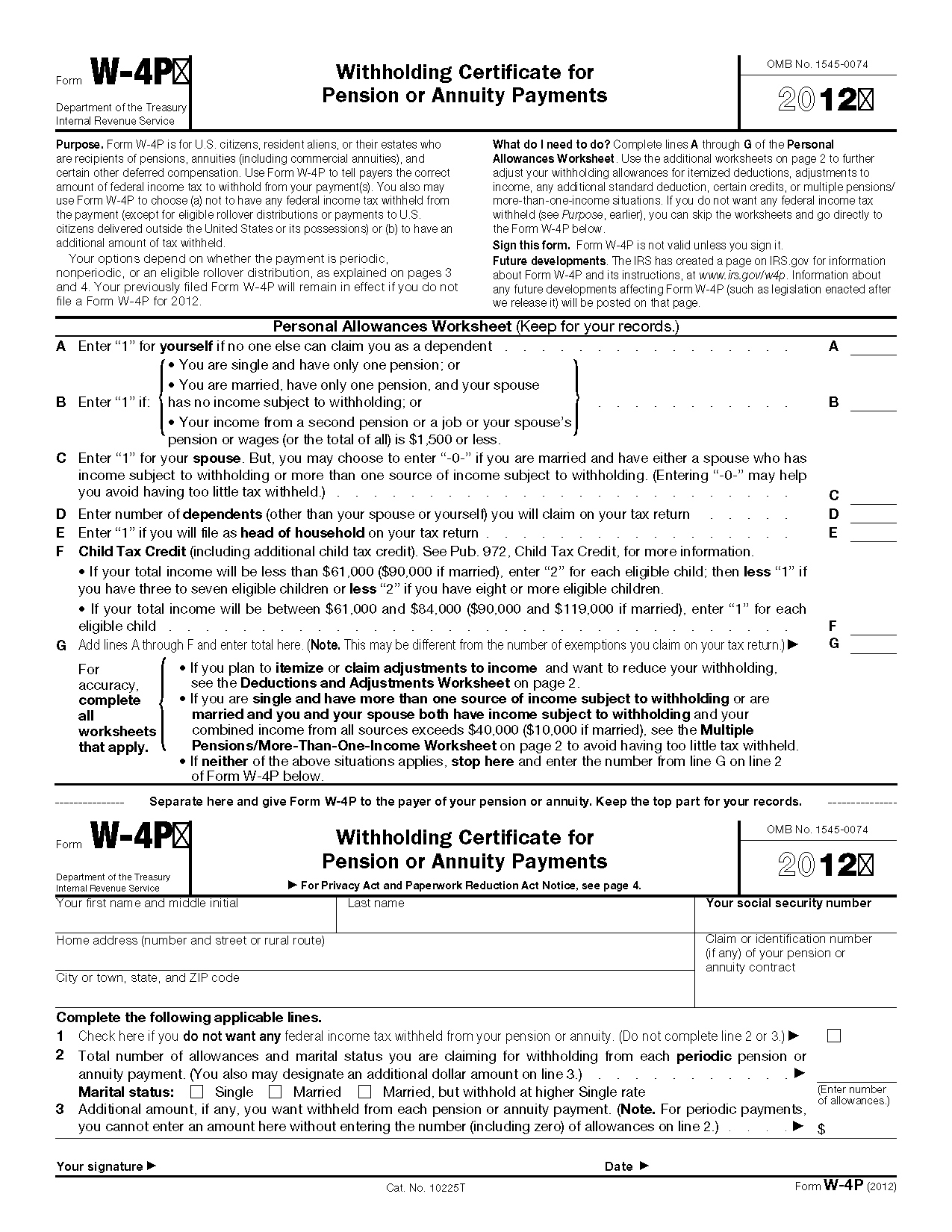

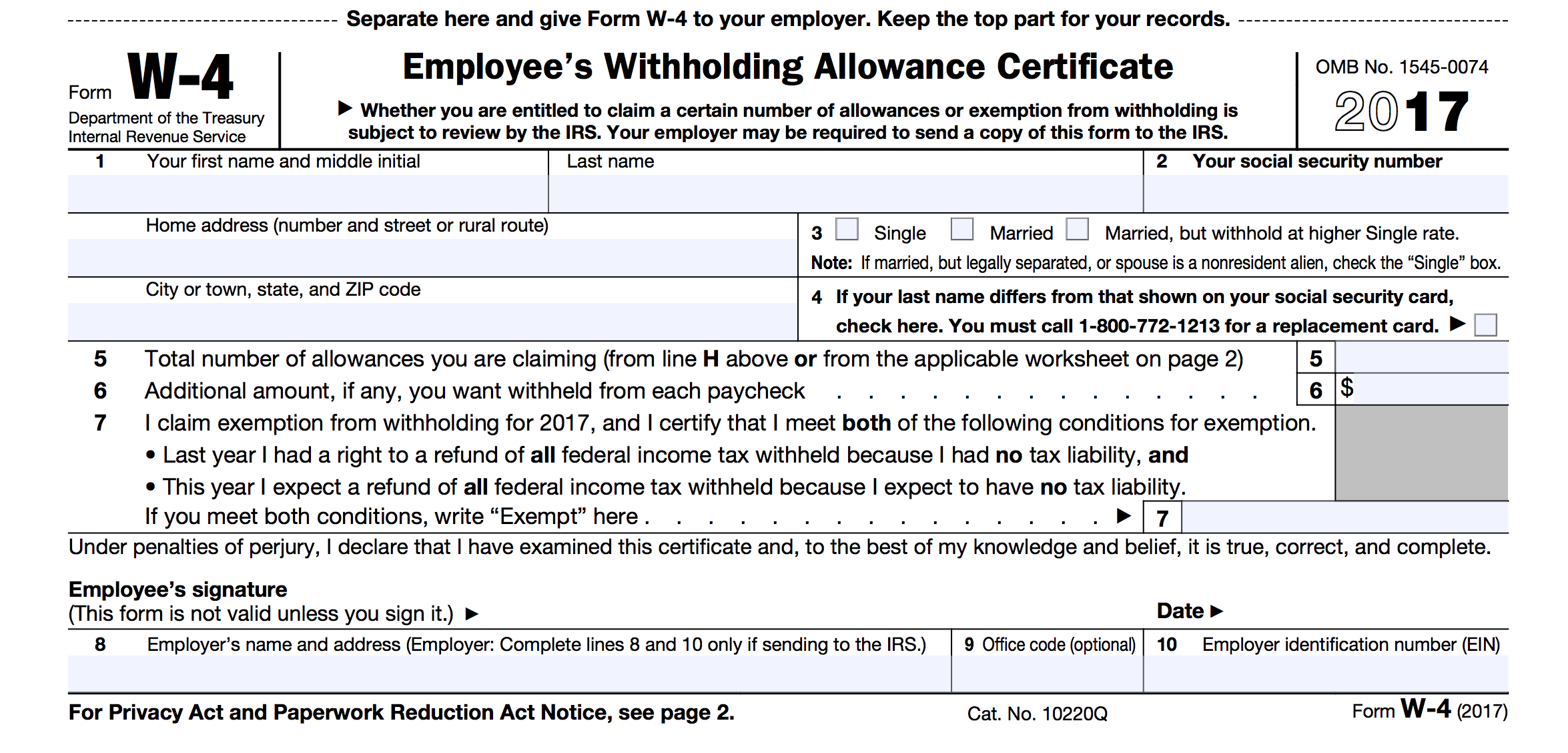

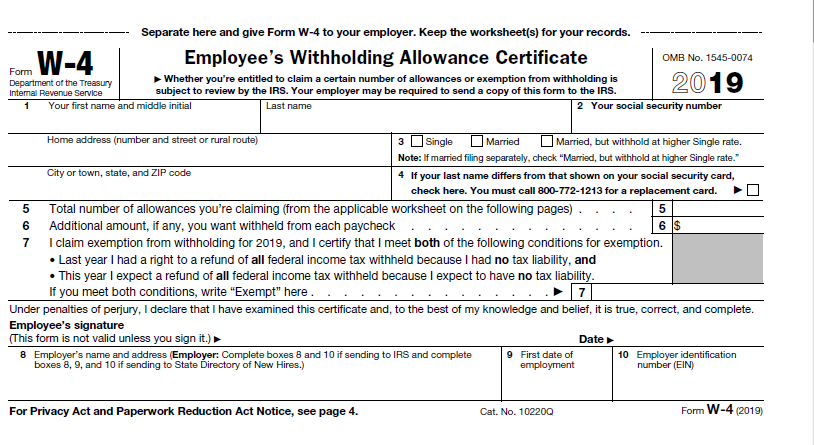

The W-4 form, formally known as the “Employee’s Withholding Certificate,” is a document provided by the Internal Revenue Service (IRS). It is used by employers to determine the amount of federal income tax to withhold from an employee’s paycheck. This ensures that individuals meet their tax obligations and avoid underpaying or overpaying their taxes.

The W-4 form, formally known as the “Employee’s Withholding Certificate,” is a document provided by the Internal Revenue Service (IRS). It is used by employers to determine the amount of federal income tax to withhold from an employee’s paycheck. This ensures that individuals meet their tax obligations and avoid underpaying or overpaying their taxes.

Each year, the IRS updates the W-4 form to reflect any changes in tax laws or regulations. It is important to use the most recent version of the form to ensure accurate withholding. Keeping track of these updates can be cumbersome, but luckily, various resources provide printable versions of the W-4 form.

Each year, the IRS updates the W-4 form to reflect any changes in tax laws or regulations. It is important to use the most recent version of the form to ensure accurate withholding. Keeping track of these updates can be cumbersome, but luckily, various resources provide printable versions of the W-4 form.

Filling Out the W-4 Form

Now, let’s dive into how to complete the W-4 form. It begins with providing your personal information, such as your name, address, and social security number. Next, you’ll need to indicate your filing status, such as single, married filing jointly, or head of household, which impacts the tax rates and deductions.

Now, let’s dive into how to complete the W-4 form. It begins with providing your personal information, such as your name, address, and social security number. Next, you’ll need to indicate your filing status, such as single, married filing jointly, or head of household, which impacts the tax rates and deductions.

The form also has sections for additional income, deductions, and adjustments that you anticipate for the year. These factors help determine your tax liability accurately. To assist you in filling out these sections correctly, the IRS provides detailed instructions on the form itself or as a separate document.

The form also has sections for additional income, deductions, and adjustments that you anticipate for the year. These factors help determine your tax liability accurately. To assist you in filling out these sections correctly, the IRS provides detailed instructions on the form itself or as a separate document.

If you reside in a state that has separate state income taxes, like Wisconsin, you may also need to complete a state-specific version of the W-4 form. This ensures that the correct amount of state income tax is withheld from your paycheck.

If you reside in a state that has separate state income taxes, like Wisconsin, you may also need to complete a state-specific version of the W-4 form. This ensures that the correct amount of state income tax is withheld from your paycheck.

Understanding Your Withholdings

Completing the W-4 form accurately is crucial to avoid any unexpected tax bills or large refunds when you file your annual tax return. It is essential to review your withholdings periodically and make changes as necessary. Major life events, such as a marriage, divorce, birth of a child, or changes in employment, can impact your tax situation and require adjustments to your W-4 form.

Completing the W-4 form accurately is crucial to avoid any unexpected tax bills or large refunds when you file your annual tax return. It is essential to review your withholdings periodically and make changes as necessary. Major life events, such as a marriage, divorce, birth of a child, or changes in employment, can impact your tax situation and require adjustments to your W-4 form.

To better understand how to fill out your W-4 form, you can refer to the sample completed W-4 forms available online. These samples serve as a helpful guide to ensure that you provide accurate information and maximize your tax benefits.

To better understand how to fill out your W-4 form, you can refer to the sample completed W-4 forms available online. These samples serve as a helpful guide to ensure that you provide accurate information and maximize your tax benefits.

Online Options for Filling Out Your W-4 Form

In today’s digital age, you have the option to fill out your W-4 form online. Various platforms offer interactive, fillable PDF versions of the form that can be completed digitally, making the process more efficient and error-free.

In today’s digital age, you have the option to fill out your W-4 form online. Various platforms offer interactive, fillable PDF versions of the form that can be completed digitally, making the process more efficient and error-free.

By utilizing these online resources, you can quickly and easily navigate through the form, ensuring accuracy and completeness. Additionally, they often provide prompts and guidelines to help you answer each question correctly.

By utilizing these online resources, you can quickly and easily navigate through the form, ensuring accuracy and completeness. Additionally, they often provide prompts and guidelines to help you answer each question correctly.

Signing Your W-4 Form Electronically

Once you have completed the W-4 form, you may need to sign it before submitting it to your employer. Electronic signature platforms, such as DigiSigner, offer secure and convenient ways to sign documents electronically, saving you time and preventing the need for printing and scanning.

Once you have completed the W-4 form, you may need to sign it before submitting it to your employer. Electronic signature platforms, such as DigiSigner, offer secure and convenient ways to sign documents electronically, saving you time and preventing the need for printing and scanning.

In summary, the W-4 form is a significant document that ensures accurate tax withholding throughout the year. Completing it correctly is crucial to avoid any surprises when filing your taxes. Utilizing printable versions of the form, following instructions carefully, and taking advantage of online resources can simplify and streamline the process. By staying on top of your tax withholdings, you can maintain financial stability and ensure compliance with tax laws.